After last month's gory detail on the UK's financial vulnerability, another barrage of charts from Zero Hedge illustrates why the fasten seat belt sign remains switched on.

After last month's gory detail on the UK's financial vulnerability, another barrage of charts from Zero Hedge illustrates why the fasten seat belt sign remains switched on. The charts show the vast quantity of government debt issued by Portugal, Ireland (and/or Italy), Greece and Spain (now called the "GIPS", to be politically correct) due to be repaid ("mature") simultaneously.

"So what?" you may ask, if you've been distracted by the UK elections.

The charts also reveal high unemployment, budget deficits and public borrowing. So these countries will struggle to pay investors to extend the due dates ("maturities") on existing loans - “amend and extend” in callous market jargon. Investors will cut their losses and/or refuse to lend at less than credit card rates. Bail-out bodies, like the International Monetary Fund (IMF) will only help if the country concerned can implement 'austerity measures' to cut its deficit and get its economy under control.

The results of suddenly imposing such measures on citizens who hadn't realised how bad things were - or why - can be seen on Greek streets:

Not great for tourism, one of Greece's only growth areas.

In fact, Zero Hedge is tipping "the inevitable disintegration of the eurozone and the upcoming eventual debt payment moratorium." Which means there's a lot more mayhem to come for the European financial system. And even the EuroZerozone" countries with the deepest pockets - like Germany and France - could need to rein-in substantially.

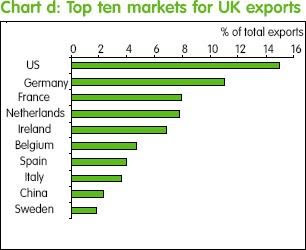

So, if the UK is to reverse its trade deficit, it must find new export markets pretty fast. Here's how Economics Weekly thought 2010 would play out on the export front as at 1 March (i.e. before the Greek bail-out):

Given the speed of deterioration in the Greek scenario during April, the demand from EU countries may well be over-stated. And the debt maturity charts suggest 2011 could be worse.

A good time to go long Chinese riot shields?

No comments:

Post a Comment