"China is significantly more exposed to Europe than the US, and is also Japan’s biggest trade partner... when the euro plunged, one of the hardest-hit stock markets was China (“because China now sells around a quarter more to Europe than to the US, and is highly sensitive to a slowdown in exports”). [So, for Asia, a week Euro means]:

- Europe will buy less from Japanese companies.

- European companies, particularly German ones, will be made incomparably stronger and more competitive by the weak currency.

- Europe will buy less from China, which will damage Chinese growth and hence depress the prices of commodities, which “anyway tend to follow a similar dynamic to the euro exchange rate”.

One area of Chinese activity in the spotlight recently is sub-Saharan Africa. It's a sign of China's

special focus on the region that 2006 was China's "Year of Africa". The

web site devoted to Sino-African relations lists extensive contacts between the regions, and China

recently announced its biggest deal in South Africa (to build a cement plant) since investing $5.5bn in Standard Bank in 2007.

Western government hand-wringing about the ugly track record of some African nations seems to hide a reluctance to engage effectively in the region generally, and perhaps a desire to undermine the success of more adroit competitors. The blurb for Patrick Bond's book "

Looting Africa: The Economics of Exploitation" suggests why:

"Despite the rhetoric, the people of Sub-Saharan Africa are become poorer. From Tony Blair's Africa Commission, the G7 finance ministers' debt relief, the Live 8 concerts, the Make Poverty History campaign and the G8 Gleneagles promises, to the United Nations 2005 summit and the Hong Kong WTO meeting, Africa's gains have been mainly limited to public relations. The central problems remain exploitative debt and financial relationships with the North, phantom aid, unfair trade, distorted investment and the continent's brain/skills drain. Moreover, capitalism in most African countries has witnessed the emergence of excessively powerful ruling elites with incomes derived from financial-parasitical accumulation. Without overstressing the "mistakes" of such elites, this book contextualises Africa's wealth outflow within a stagnant but volatile world economy."

Other commentary on the significant development aid donors

Germany, the

UK and

France is also less than flattering (though it's worth pointing out that France Telecom is a major investor in

one of Africa's undersea cable projects, while

Alcatel-Lucent is the lead contractor on another). The

US approach to the sub-Sahara region has also needed realignment:

"With the collapse of the Soviet Union leaving both an economic and power vacuum, Bill Clinton began a program of engagement with Sub-Saharan Africa’s economic powers like Nigeria and in encouraging passage the Congress of the Africa Growth and Opportunity Act which reduced trade barriers between the U.S. several African countries... George W. Bush followed on Clinton’s achievements... and is widely regarded as the U.S. President who did most for the advancement of the African people by bringing American money to bear on myriad social and health problems... [including] the goal of eliminating malaria and offering AIDS treatment to many who need it with the backing of $20 billion in U.S. aid grants."

Against this background, it's worth carefully considering

the criticism that:

"Chinese companies are the second-most likely (after India) to use payola abroad, according to

Transparency International's Bribe Payers Index. Similarly, a

World Bank survey of 68 countries last year found that the sub-Sahara leads in the "percentage of firms expected to give gifts" to secure government contracts (43%). That meeting of the minds has made for hyperefficient deal making in Africa."

"As a donor, China’s way has several advantages... The focus on turnkey infrastructure projects is far simpler and doesn’t overstretch the weak capacity of many African governments faced with multiple meetings, quarterly reports, workshops, and so on. Their experts don’t cost much. In addition, their emphasis on local ownership is genuine, even if it leads to projects like a new government office building, a sports stadium, or a conference center. They understand something very fundamental about state-building — something that Pierre L’Enfant understood in 1791 when he teamed up with George Washington in newly independent America: new states need to build buildings and dignity, not simply strive to end poverty.

The Chinese avoid local embezzlement and corruption by very rarely transferring any cash to African governments. There is almost no budget support, no adjustment or policy loans. Aid is disbursed directly to Chinese companies who do the projects. The resource-backed infrastructure loans work the same way. Of course those companies themselves might give kickbacks, as we’ve seen in Namibia..."

But that is not to say such alleged activity goes unchallenged,

as reports of the Namibian case reveal. Nor does Brautigam gloss over China's role in the Sudan, which has attracted intense criticism. However, she points out:

"First, China’s role in Sudan has changed over the past several years. They were crucial in getting Khartoum to accept a joint UN/African Union peacekeeping force (one, by the way, authorized by the UN, but not funded as generously as originally pledged). They allowed al-Bashir’s case to be sent to the International Criminal Court for prosecution for war crimes (as Security Council members, they could have vetoed this). And as noted both by President Bush’s special envoy, Andrew Natsios, and President Obama’s special envoy, Scott Gration, Beijing is now working together with the US government and other major powers in developing joint strategies to bring the Sudanese government and the rebels to the negotiating table. As China-watcher Erica Downs put it, the West and China are now coordinating their “good cop” and “bad cop” roles in trying to end the crisis.

Second, there is no doubt that Beijing could have moved much sooner, and much more effectively, to become part of the solution. But they never held all the keys to solving the Darfur tragedy. In making a tactical decision to focus on China as the lynch pin to solving Darfur’s crisis, and using the 2008 Olympics as the pressure point, activists let the other major powers off the hook. To end the violence, Darfur needs a peace agreement, and that requires all the parties to participate in negotiations. The West has not yet been able to get all the major rebel groups to show up to start talking."

So, it's clear that Africa rewards investment in education and infrastructure, even if it comes in the form of work done by foreign companies directly rather than planeloads of cash. And it's also clear there is no substitute for effective international co-ordination to call recalcitrant regimes to account over human rights. That can't be achieved by a single nation - even a 'superpower', as we've seen elsewhere.

Yet I wonder whether a bottom-up approach to investment in sub-Sahara Africa might also be far more effective than top-down donations? Apart from the provision of basic infrastructure and health services, supporting

the rise of the Cheetah Generation and facilitators like M-Pesa and the technology hubs may do more to enable individuals to seize control of their own economic destiny than merely benevolent giving.

Kiva, the microfinance provider, is a great example of this bottom-up approach:

"Kiva promotes:

•Dignity: Kiva encourages partnership relationships as opposed to benefactor relationships. Partnership relationships are characterized by mutual dignity and respect.

•Accountability: Loans encourage more accountability than donations where repayment is not expected.

•Transparency: The Kiva website is an open platform where communication can flow freely around the world.

As of November 2009, Kiva has facilitated over $100 million in loans."

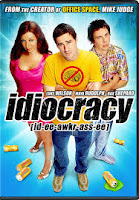

Image from Run For Africa